How To Transfer Money from BPI Family to Another Bank Account Using BPI Mobile App

If you have a BPI or BPI Family bank account, I highly suggest that you download BPI Mobile application for Android smartphone or Apple iPhone and register for an account through BPI website so you can enjoy the many perks and privileges that are made possible by this innovative mobile banking service.

One of the most useful features of the BPI Mobile App is sending money to other BPI or BPI Family Accounts or even other bank accounts without having to go to a physical branch to process the transaction.

The best part is that if you are doing it within the BPI system or if you're sending money to just another BPI or BPI Family account, the money transfer will be in real time or instantaneously.

It's true! I've done it myself when I purchased an item from an online seller who lives in another province. Let me show you how to do it.

First, simply launch the BPI Mobile App and log-in to your account.

If you don't have an account yet, you have to make one first by going to the BPI Express Online official website.

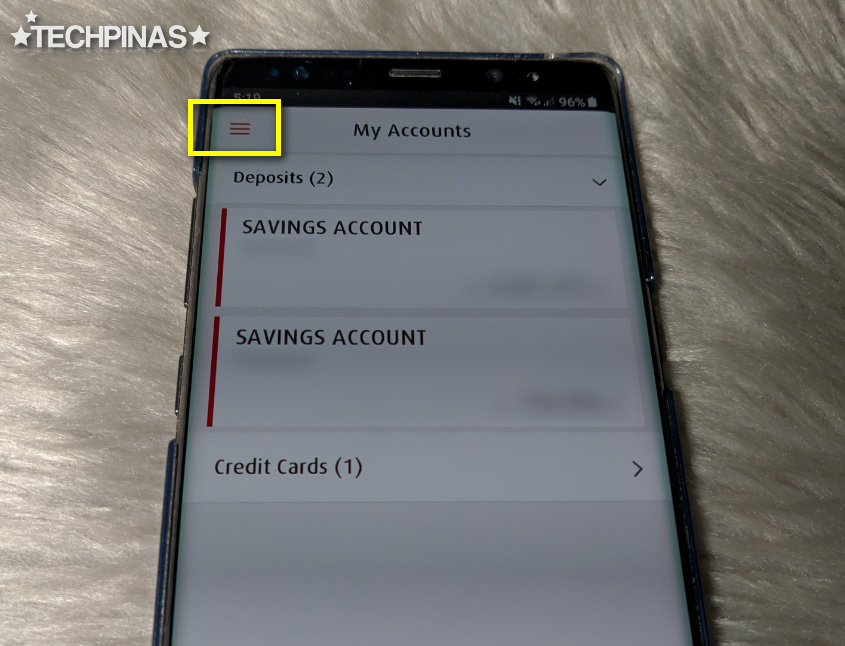

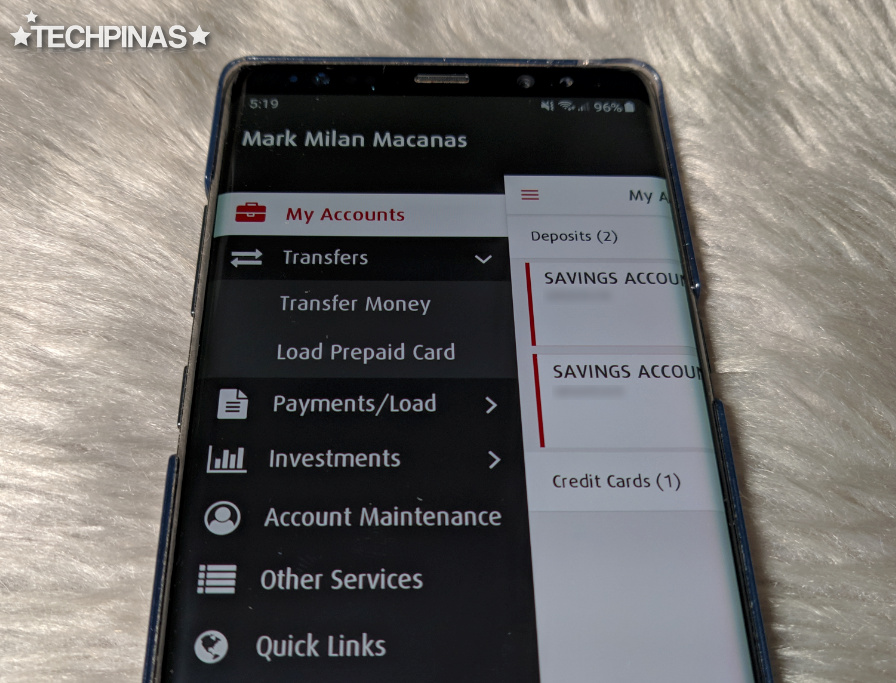

After logging in, click on the hamburger icon or menu draw located in the upper left corner of the screen as shown in the yellow box below.

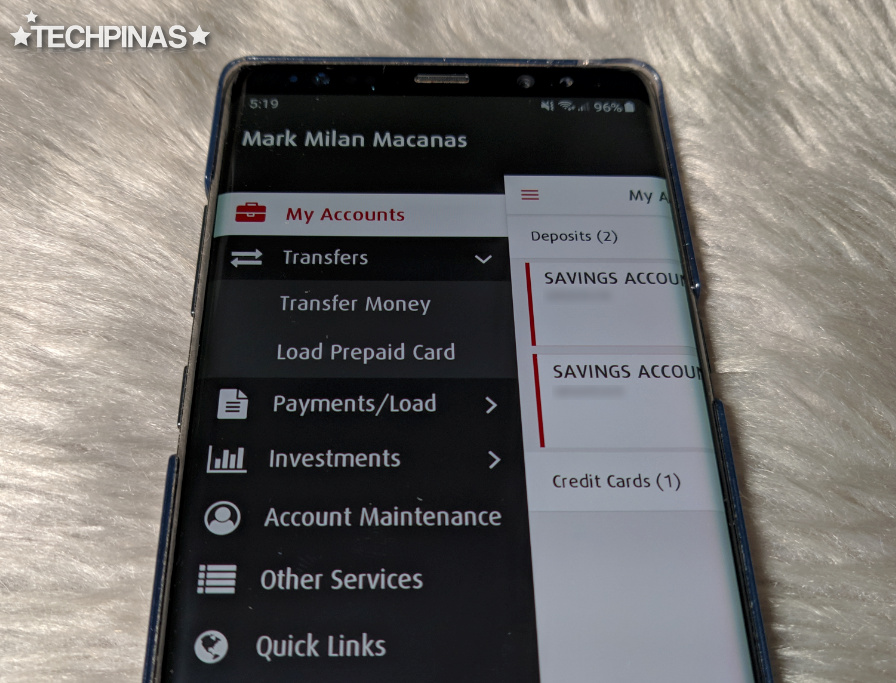

Click on Transfers menu and under it, choose Transfer Money.

Fill in all the blanks in the Transfer Money form.

Choose your Savings Accounts where you will getting the money from.

Type in the Transfer Amount. Take note of the comma and the period.

Choose Transfer to own account if you're just sending money from your account to another BPI or BPI Family account that you own.

Choose Transfer to 3rd party if you're sending money to another person's BPI or BPI Family account.

Choose Transfer to another bank if you're sending to another person who owns an account in another bank aside from BPI or BPI Family.

In my case, I was sending money to a seller who has a BPI Family account so I chose the second option.

Then, type in the Bank Account Number of the person. Note that BPI and BPI Family Bank accounts usually consist of 10 digits. If there are zeroes in the prefix, don't type those.

Double or triple check if all the details that you placed in the form are accurate.

Once you're done, click Next.

The app will then give you a confirmation page where you can re-check if all your money transfer details are correct. If you don't see errors, click the Confirm button.

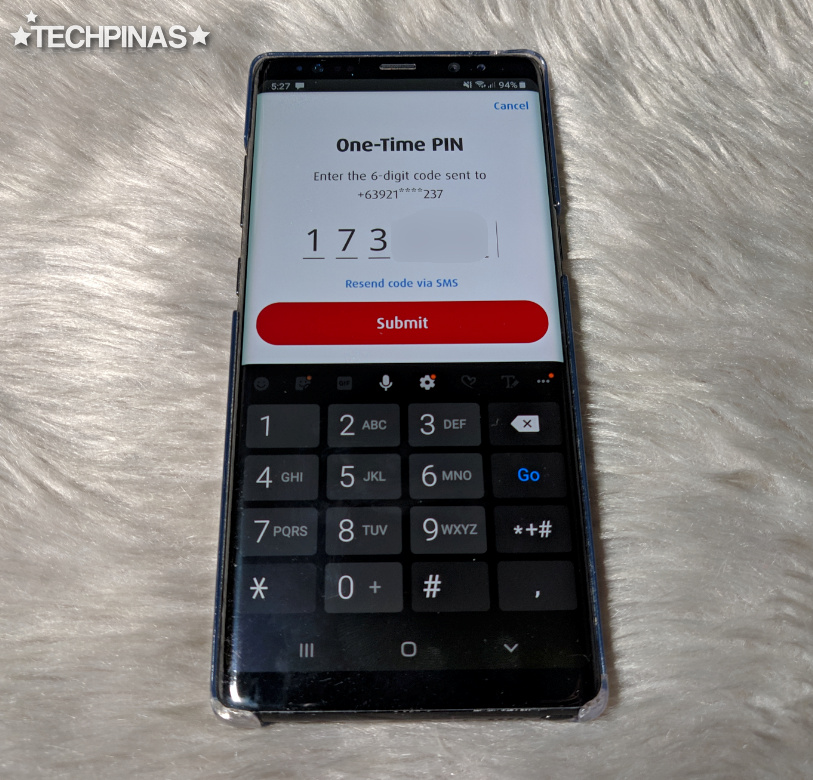

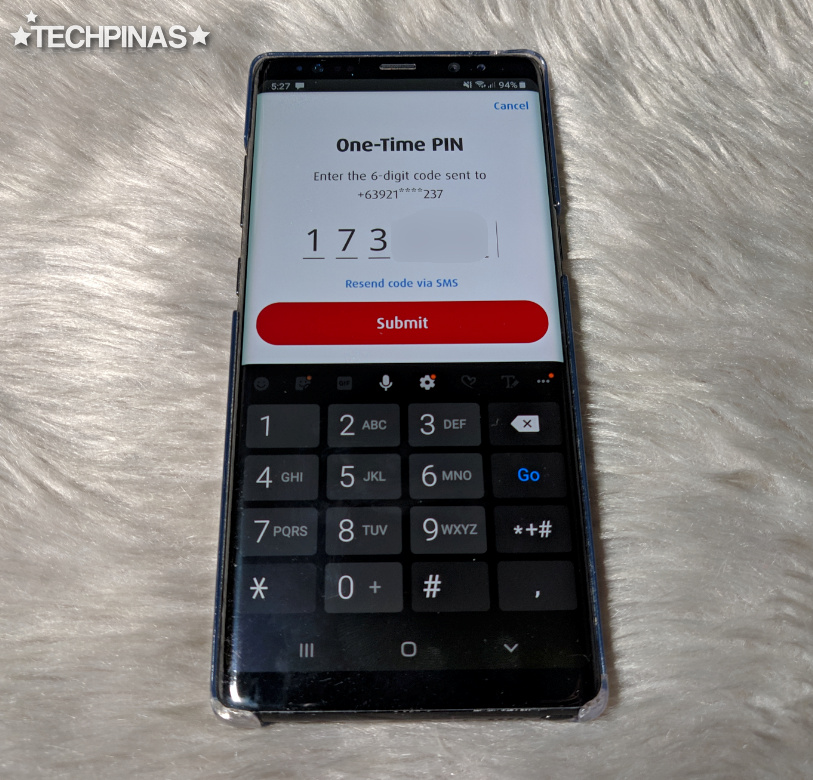

To complete the transaction, BPI Mobile App will send a Six-Digit One-Time Pin Code via SMS to the mobile number that's linked to your account. Click "Yes, send me the code" if the mobile number that the apps shows you is correct.

Just type in the One-Time PIN Code that you will receive via text message from BPI to complete the money transfer. Then, click Submit.

Doing this will complete your transaction and you will receive this confirmation message on the BPI Mobile App as well your email address that's link to your bank account.

Now, as for the transaction fees, money transfer from your account to another BPI or BPI Family account that you own is free, transfer from your account to a 3rd party BPI or BPI Family account costs PHP 10 or Free for limited period if you use a QR code, and finally, transfer to an account in another bank (via Instapay) costs PHP 50.

In my case, the BPI Account Holder to whom I sent money to didn't have a QR Code so I had to pay PHP 10 on top of the amount that I transferred.

There you have it! If you have questions, just leave them in the comment section below and I'll do my best to forward them to BPI for answers. If you found this post useful, don't forget to share this TechPinas entry to your friends on social media.

Note that BPI didn't pay for this article in any way. I just thought of sharing this information with you since I was impressed when I used this feature on my BPI Mobile App. I thought it's something other BPI and BPI Family account holders would greatly benefit from.

One of the most useful features of the BPI Mobile App is sending money to other BPI or BPI Family Accounts or even other bank accounts without having to go to a physical branch to process the transaction.

The best part is that if you are doing it within the BPI system or if you're sending money to just another BPI or BPI Family account, the money transfer will be in real time or instantaneously.

It's true! I've done it myself when I purchased an item from an online seller who lives in another province. Let me show you how to do it.

First, simply launch the BPI Mobile App and log-in to your account.

If you don't have an account yet, you have to make one first by going to the BPI Express Online official website.

After logging in, click on the hamburger icon or menu draw located in the upper left corner of the screen as shown in the yellow box below.

Click on Transfers menu and under it, choose Transfer Money.

Fill in all the blanks in the Transfer Money form.

Choose your Savings Accounts where you will getting the money from.

Type in the Transfer Amount. Take note of the comma and the period.

Choose Transfer to own account if you're just sending money from your account to another BPI or BPI Family account that you own.

Choose Transfer to 3rd party if you're sending money to another person's BPI or BPI Family account.

Choose Transfer to another bank if you're sending to another person who owns an account in another bank aside from BPI or BPI Family.

In my case, I was sending money to a seller who has a BPI Family account so I chose the second option.

Then, type in the Bank Account Number of the person. Note that BPI and BPI Family Bank accounts usually consist of 10 digits. If there are zeroes in the prefix, don't type those.

Double or triple check if all the details that you placed in the form are accurate.

Once you're done, click Next.

The app will then give you a confirmation page where you can re-check if all your money transfer details are correct. If you don't see errors, click the Confirm button.

To complete the transaction, BPI Mobile App will send a Six-Digit One-Time Pin Code via SMS to the mobile number that's linked to your account. Click "Yes, send me the code" if the mobile number that the apps shows you is correct.

Just type in the One-Time PIN Code that you will receive via text message from BPI to complete the money transfer. Then, click Submit.

Doing this will complete your transaction and you will receive this confirmation message on the BPI Mobile App as well your email address that's link to your bank account.

Now, as for the transaction fees, money transfer from your account to another BPI or BPI Family account that you own is free, transfer from your account to a 3rd party BPI or BPI Family account costs PHP 10 or Free for limited period if you use a QR code, and finally, transfer to an account in another bank (via Instapay) costs PHP 50.

In my case, the BPI Account Holder to whom I sent money to didn't have a QR Code so I had to pay PHP 10 on top of the amount that I transferred.

There you have it! If you have questions, just leave them in the comment section below and I'll do my best to forward them to BPI for answers. If you found this post useful, don't forget to share this TechPinas entry to your friends on social media.

Note that BPI didn't pay for this article in any way. I just thought of sharing this information with you since I was impressed when I used this feature on my BPI Mobile App. I thought it's something other BPI and BPI Family account holders would greatly benefit from.