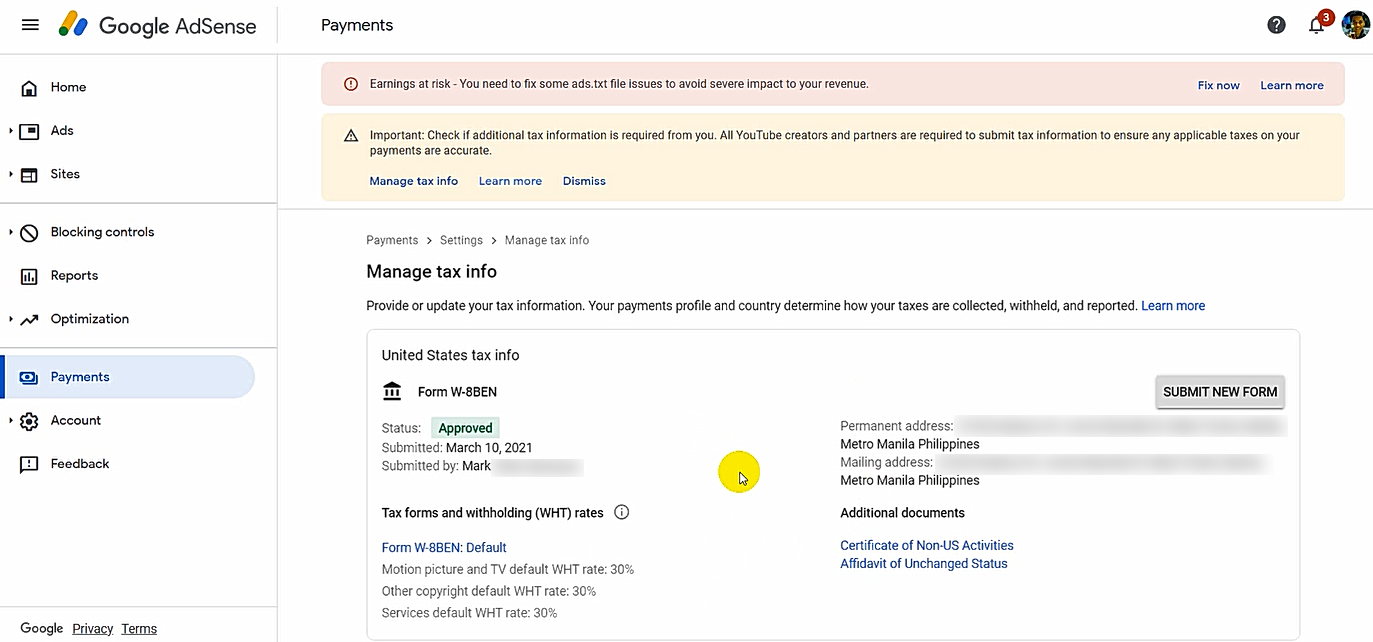

My Google Adsense Tax Information Details in the Philippines as Blogger and Youtube Partner Video Content Creator

Earlier this month - March 2021, Google Adsense started to ask its partner

publishers worldwide to submit or manage their new US Tax Information

details to ensure that applicable taxes on payments are accurate.

As a result, many of my blogger and vlogger friends here in the Philippines

have been messaging me and asking for advice on how to fill-up the form

properly since I'm one of the more veteran Google Adsense Partners in our

country.

I can't really say for sure if the way I answered my own Tax Info form is

the ideal way to do it but nonetheless, as per your request, I'd like to

share you how I did it.

>

Let's do this step by step.

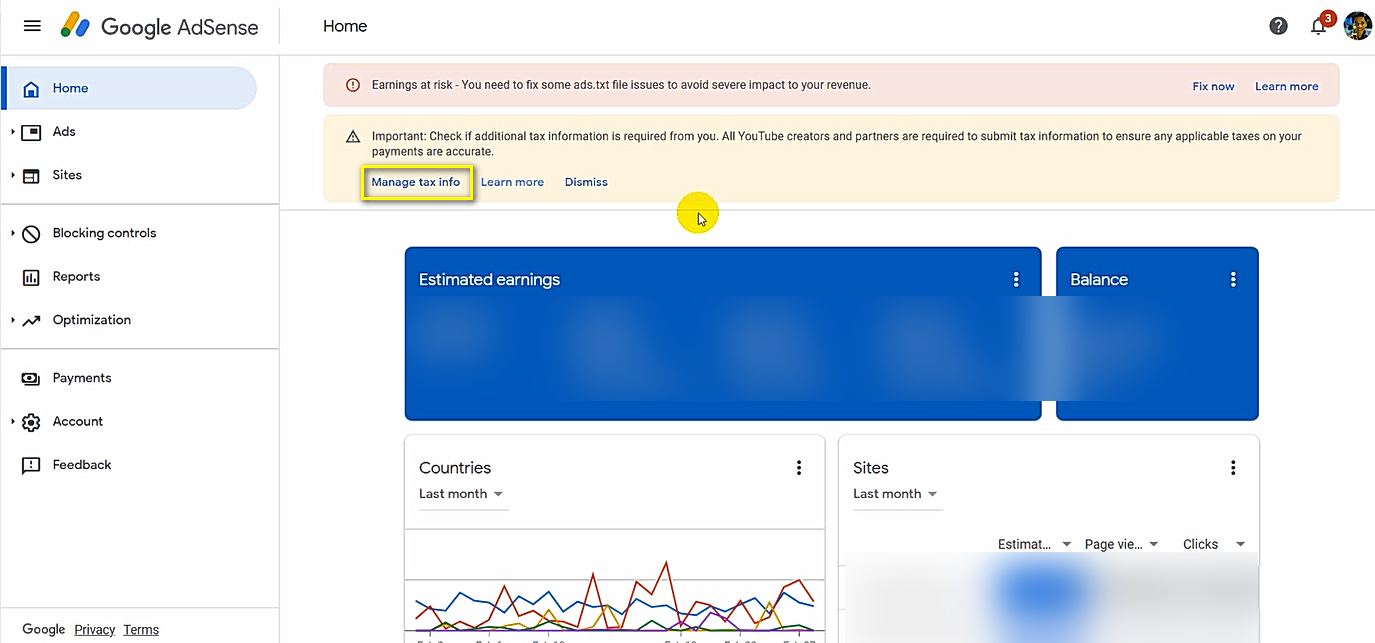

1. To create or manage your Tax Information form, simply click on "Manage tax

info" link on the notification on top of your Adsense home screen.

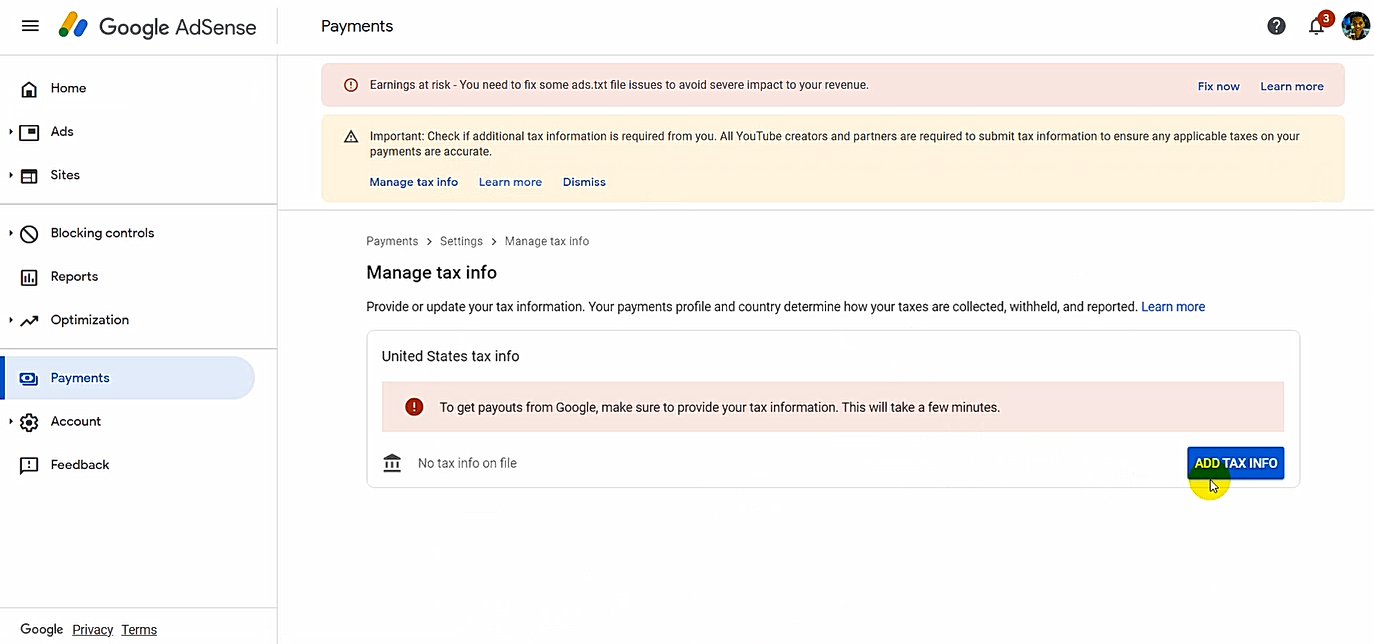

2. In the next screen, click the blue "Add Tax Info" button.

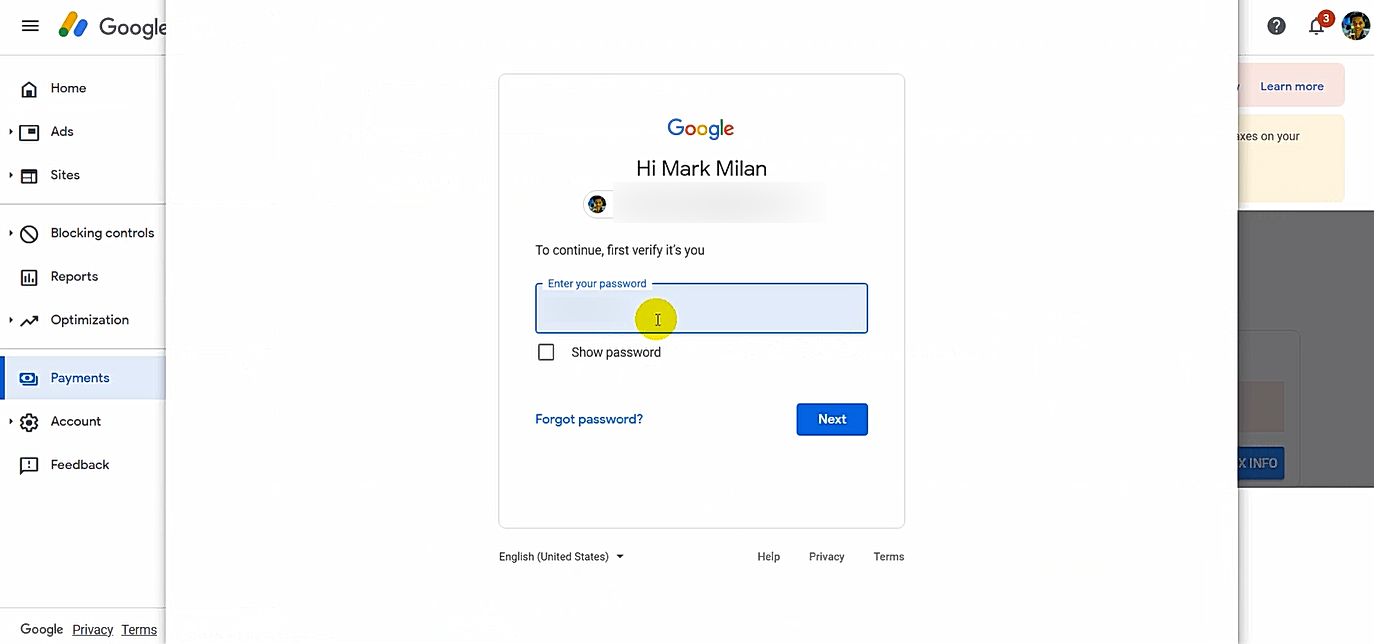

3. You would then have to type in your username and password again for

verification.

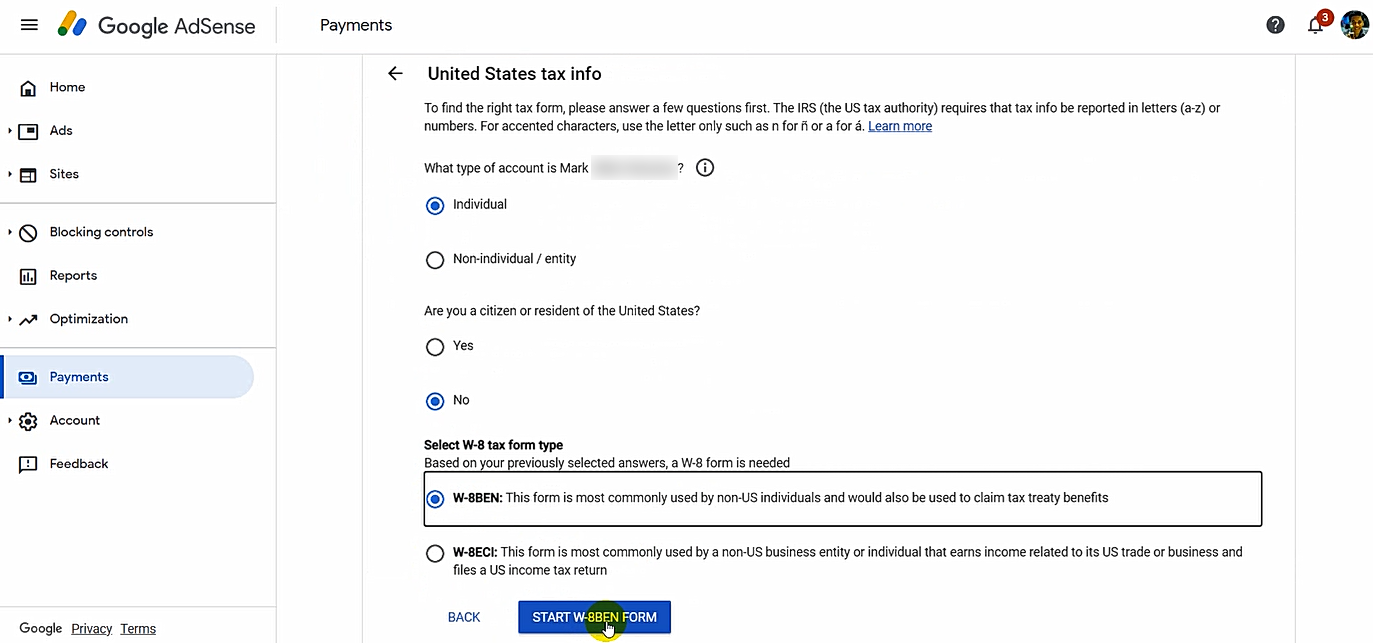

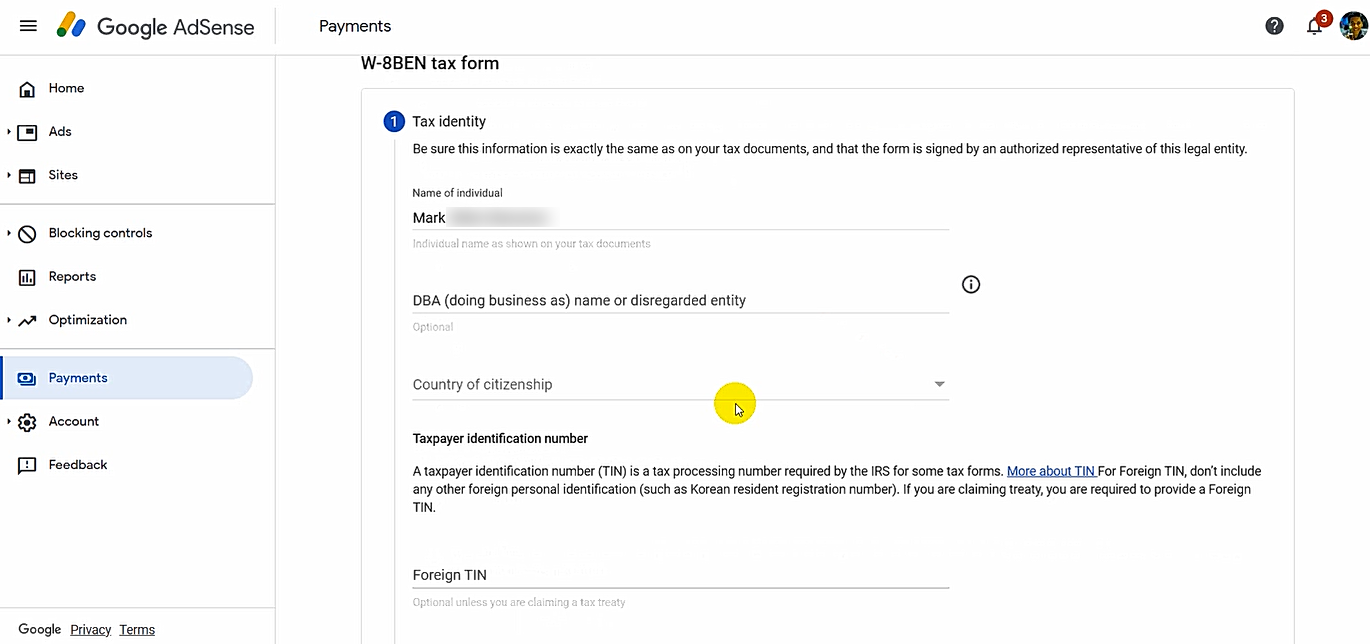

4. As a solo Filipino blogger who is not affiliated with a company, I chose

"Individual", "No", and "W-8BEN" in the type of account, US citizenship, and

W-8 tax form type options. Your case may be different so make the proper

choice.

5. Next, I just typed in my name and skipped the option of adding a business

name.

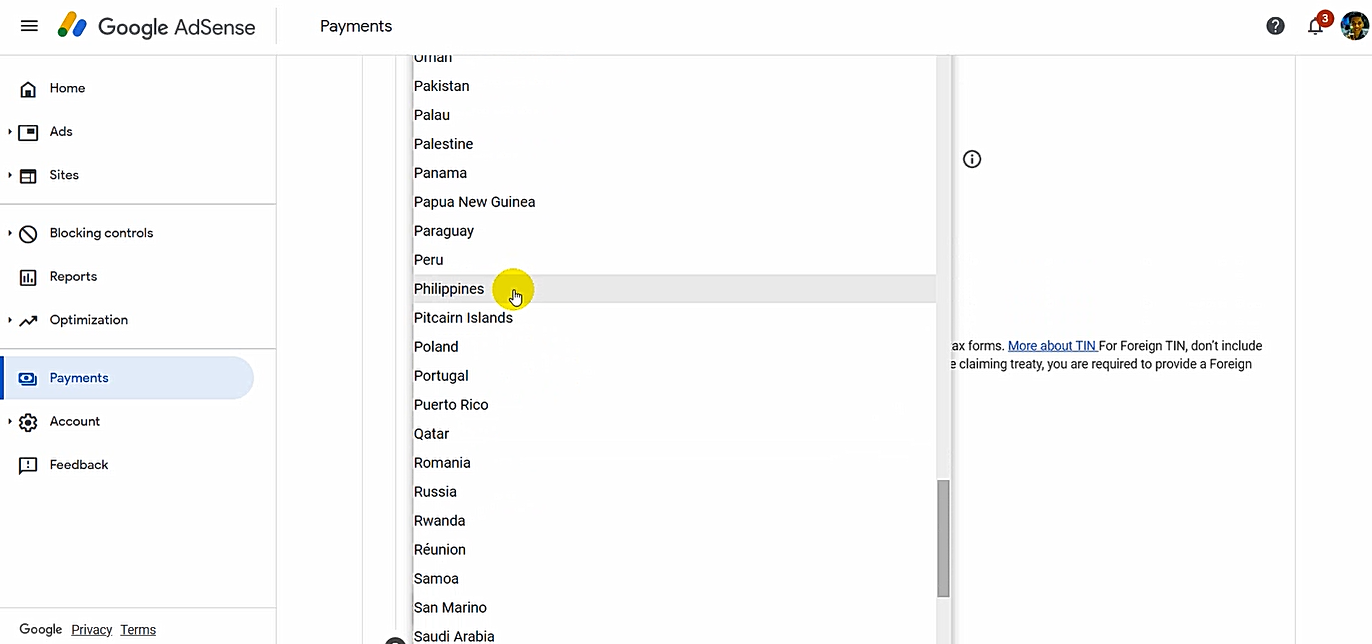

6. I then chose the Philippines as my country of citizenship.

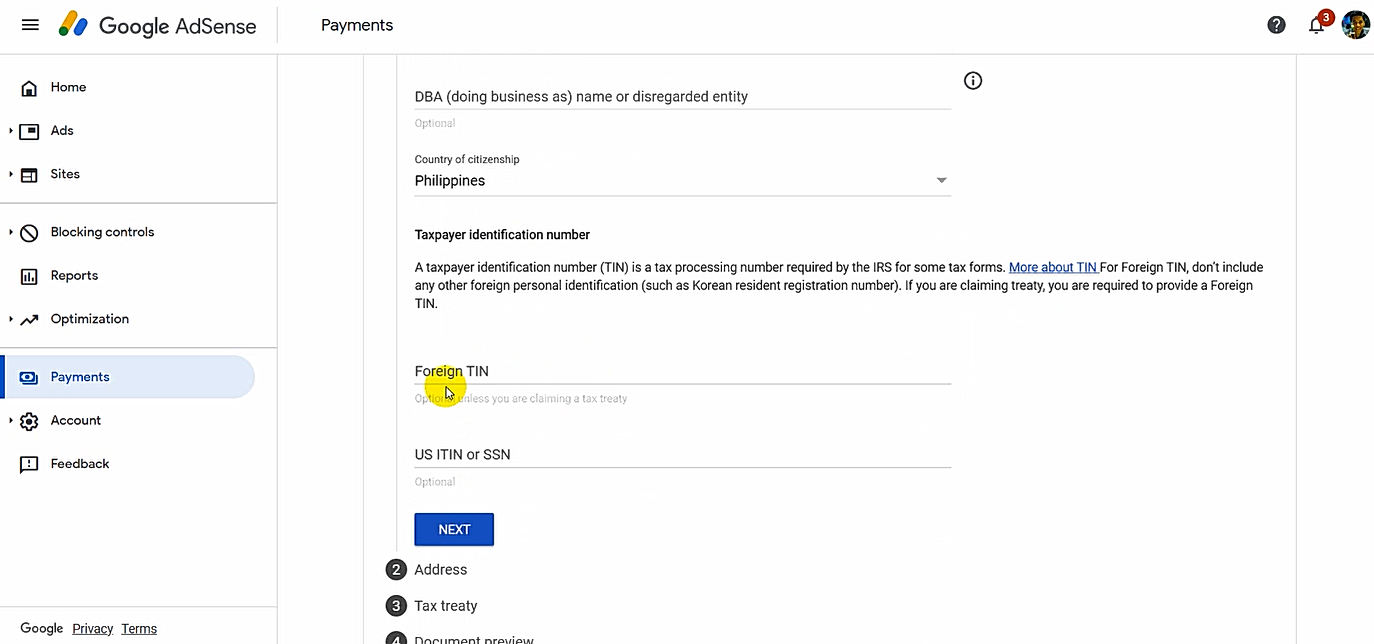

7. I don't have a Foreign TIN (Tax Identification Number) so I just left

those spaces blank. You would need a Foreign TIN if you're applying for Tax

Treaty discount.

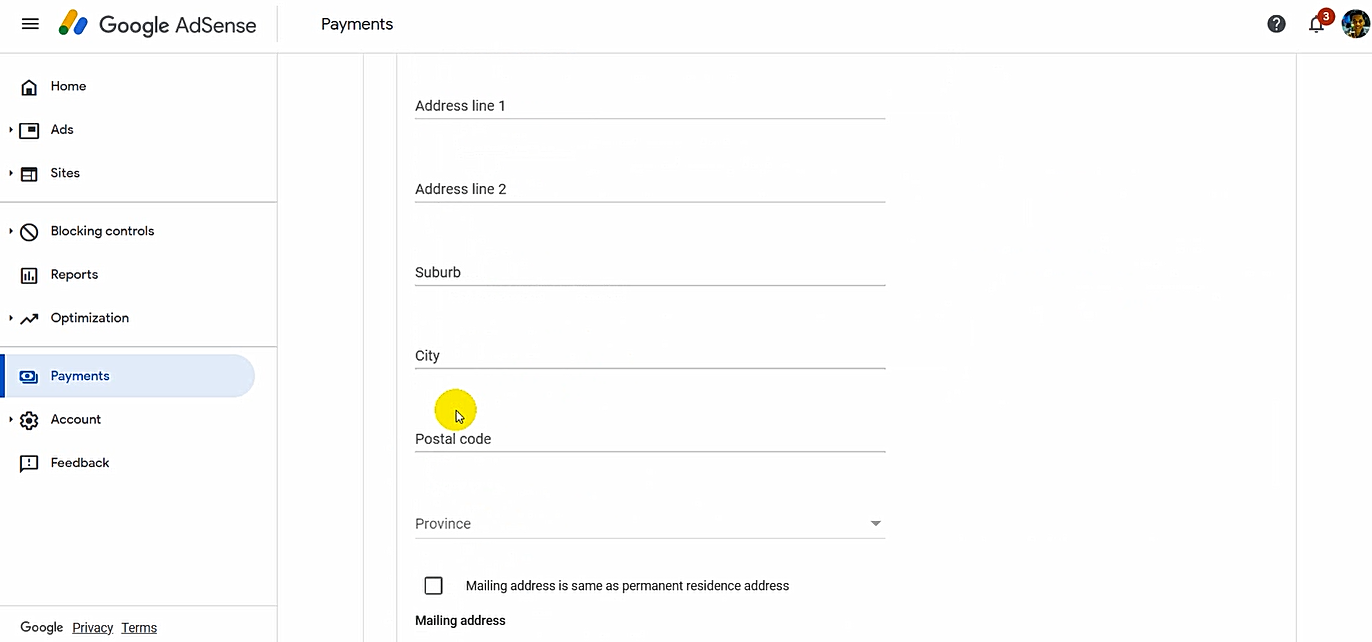

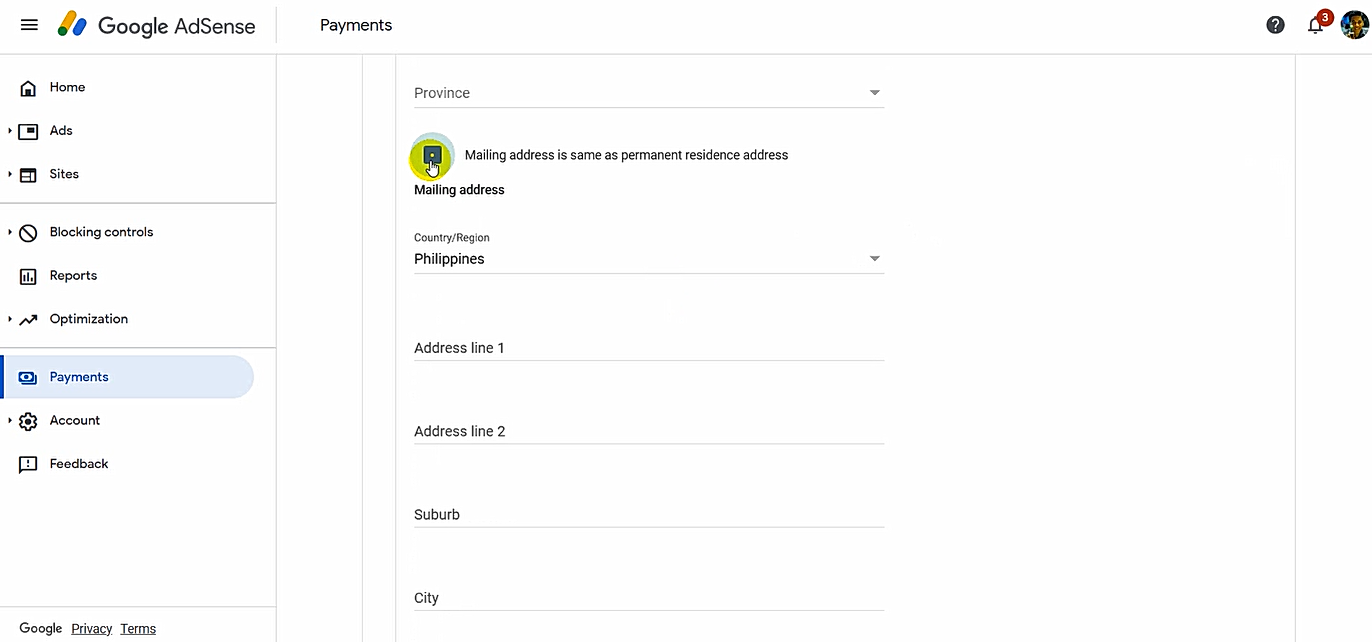

8. Moving forward, you just need to type in your current permanent resident

address.

I ran an issue with the "postal code". Google Adsense just won't accept my

correct zip code here in Metro Manila so I just left it blank.

9. Tick the box for "Mailing address is same as permanent address" if you

receive your mails at the residence address you provided.

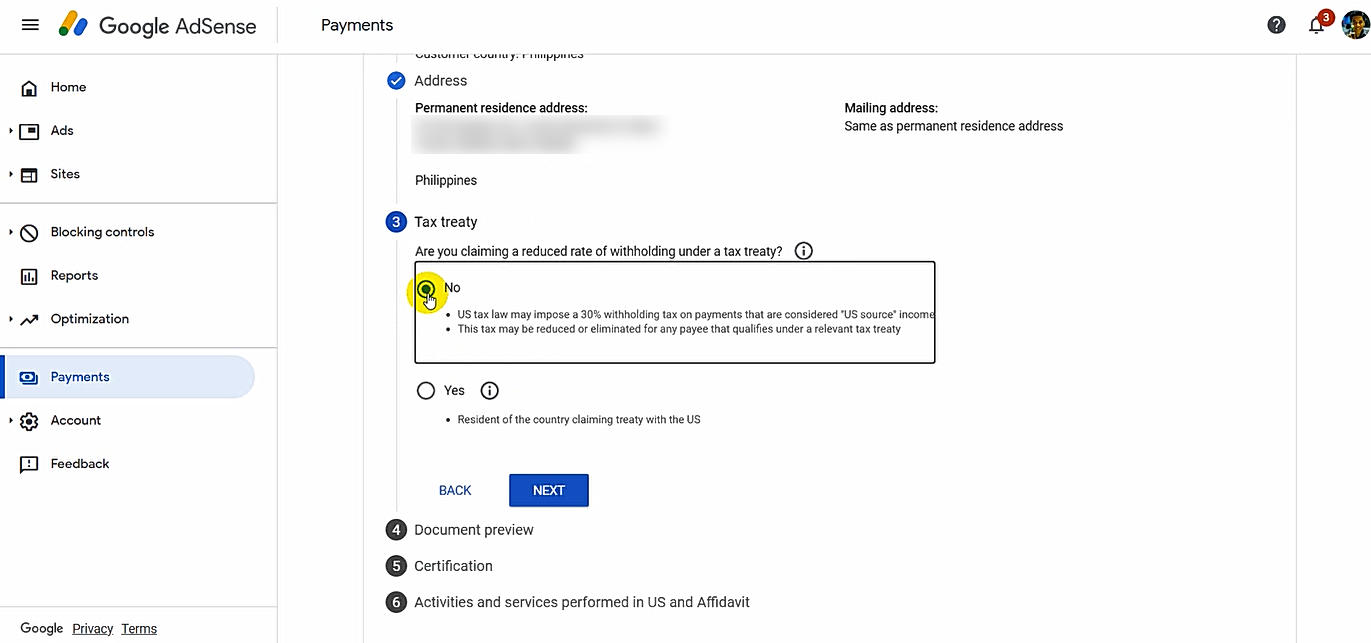

10. This is perhaps the most important part of this process: The US Tax Treaty

section.

The Philippines actually has a Tax Treaty Agreement with the United States to prevent double-taxation.

However, to enjoy it, I believe you would need a Foreign Tax Identification

Number, which is - as I've said - something I don't have.

Hence, I simply picked "No", which means that the United Stated may impose

a 30% WHT on payments considered as "US Sourced" income. Nonetheless, this

may be reduced or even eliminated for any payee that qualifies under a

relevant tax treaty. I thought it sounded fair so I went with it.

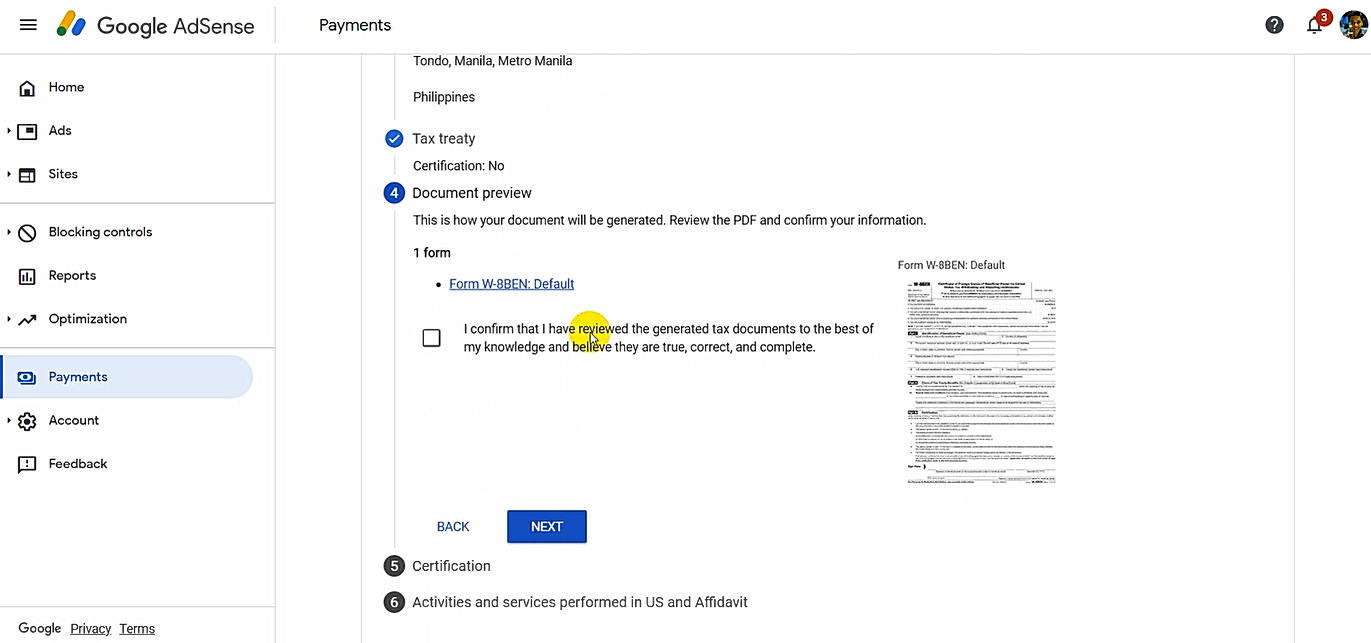

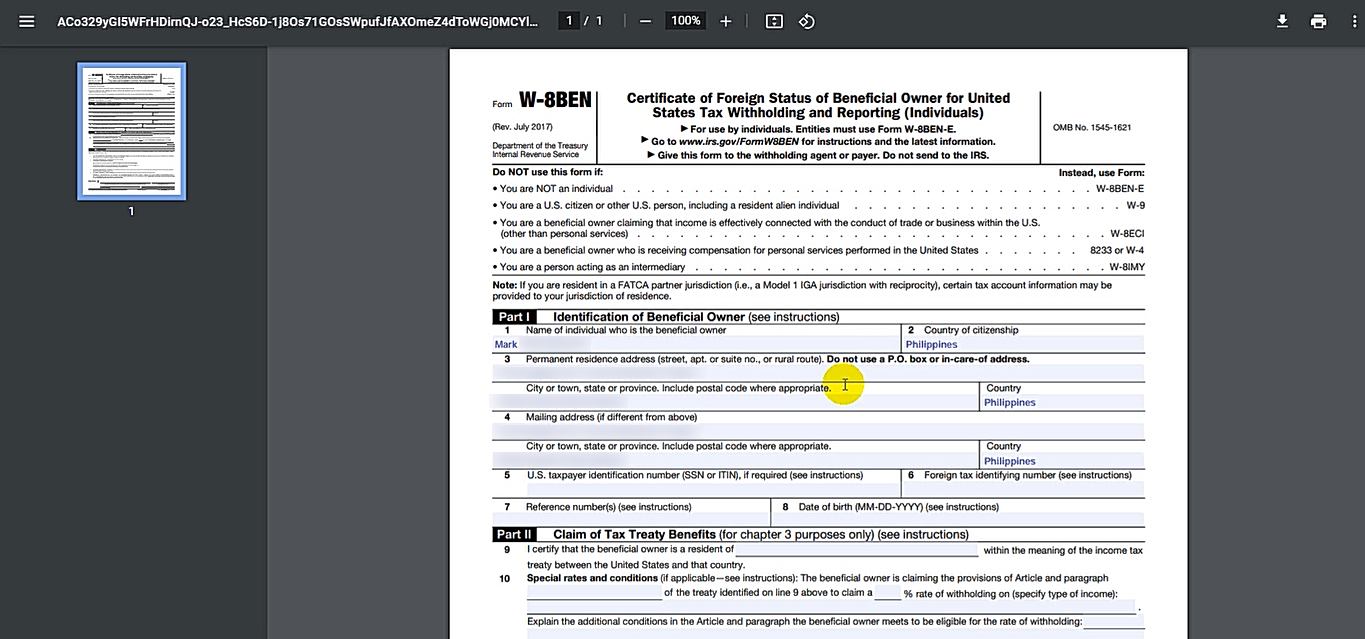

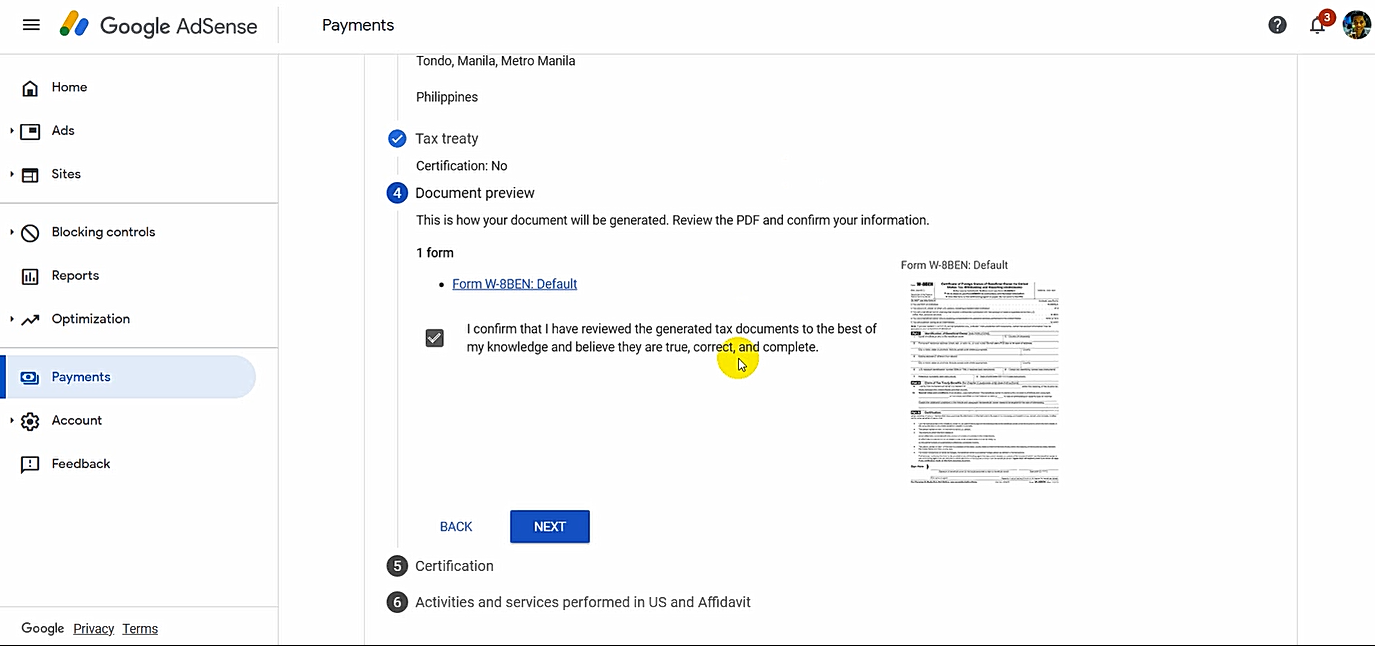

11. After that I previewed my filled-up W-8BEN document and checked if all the

details are correct.

12. When I saw that all details are accurate, I ticked the confirmation

box.

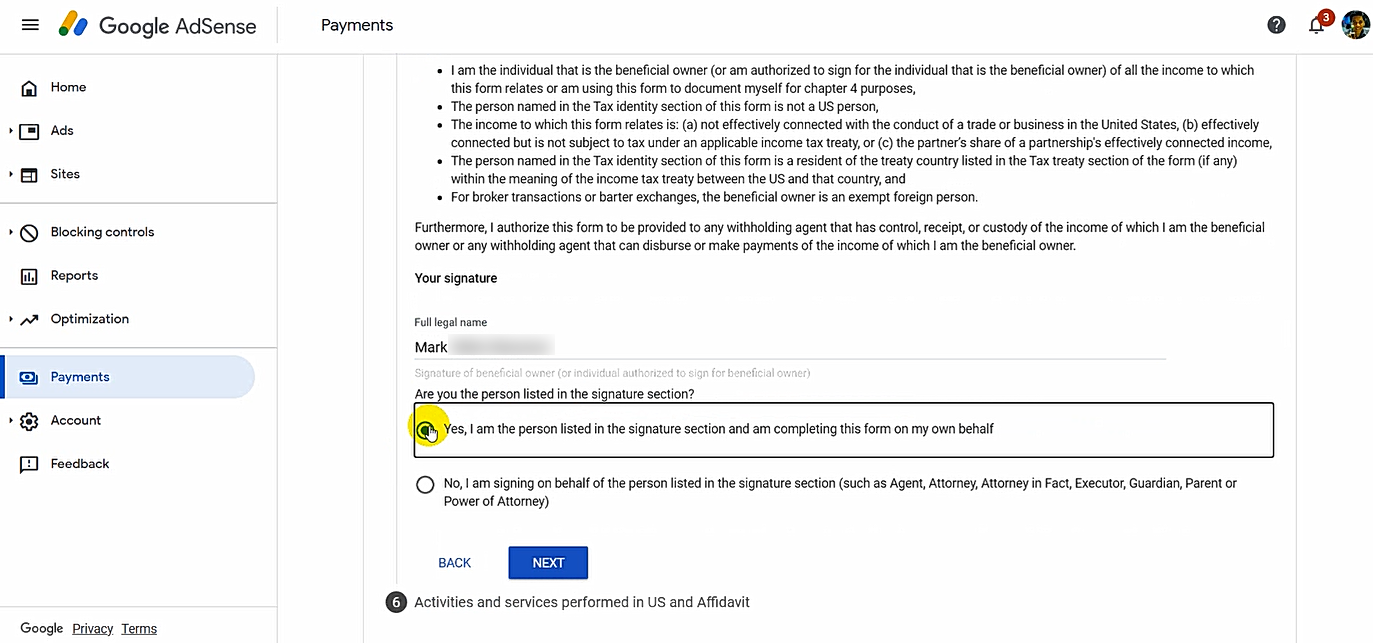

13. Clicking on the "Next" button, I was taken to the Digital Signature

section.

14. I just typed in my name and chose "Yes, I am the person listed in the

signature section and am completing this form on my own behalf." Obviously, if

you have your lawyer or representative fill-up the form for you, they would

have to type in their own names.

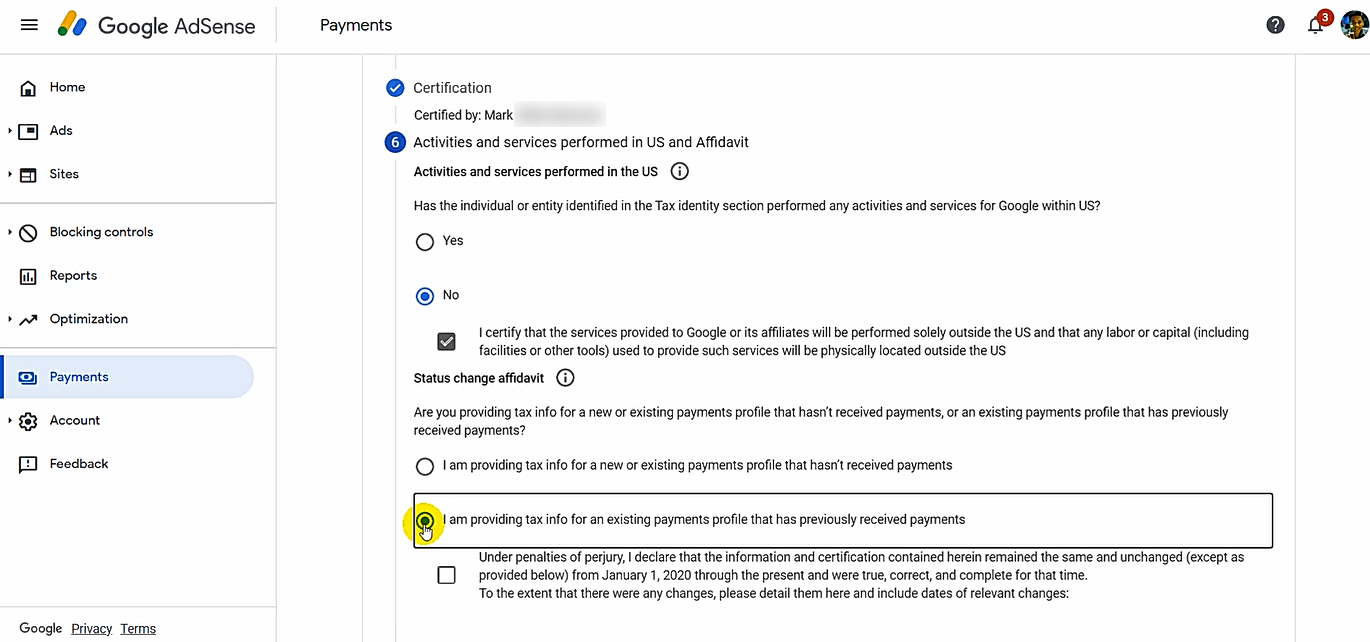

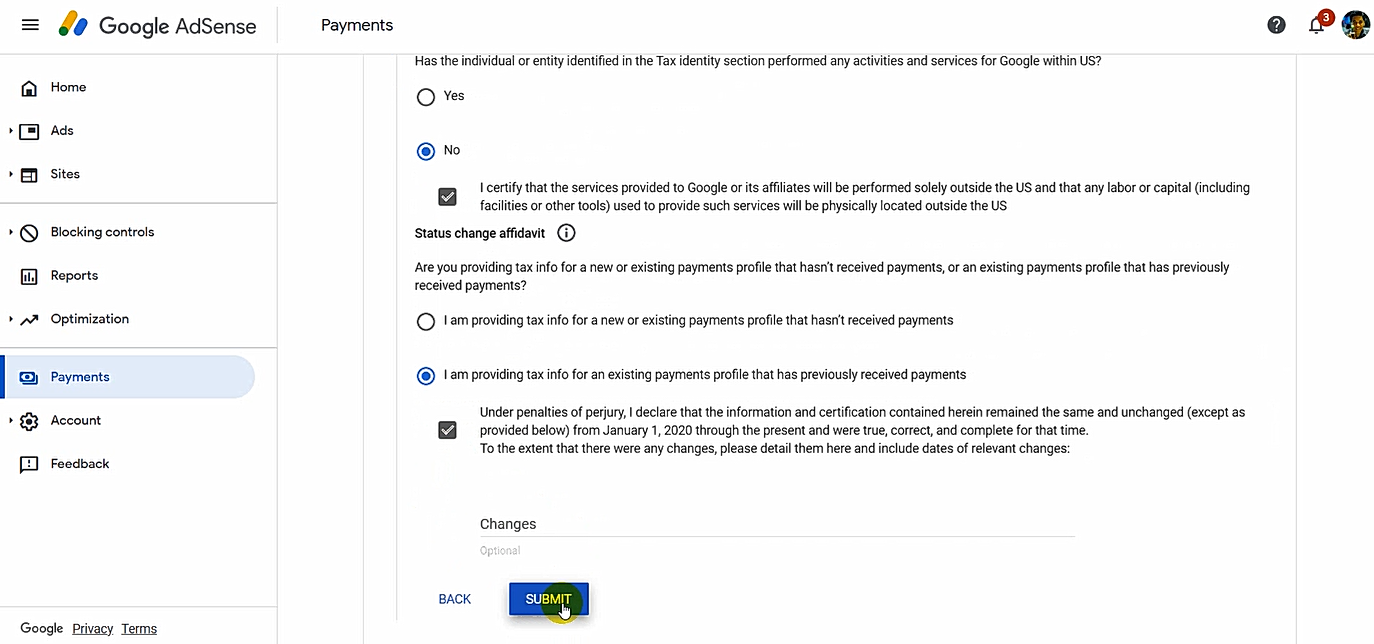

As shown in the image above, I also picked "No" as my answer when asked if I have performed any activities and services for Google within the United States.

15. Finally, I just clicked submit to wrap up the process! Voila!

After a few minutes, I again clicked on the "Manage tax info" link on the

notification on top of the home screen and I saw that my Form W-8BEN has been

approved by Google Adsense.

Again, I just shared how I - personally - filled up the form as requested

by some of my peers. Each of us may have a different case so I don't suggest

that you copy all the choices I made above. Nevertheless, if you think we

share a similar profile, then - by all means, study how I did it. Cheers!